Target Minerals:Gold & Copper

Ownership

GoldQuest owns a 100% interest in the Romero project

Location & Access

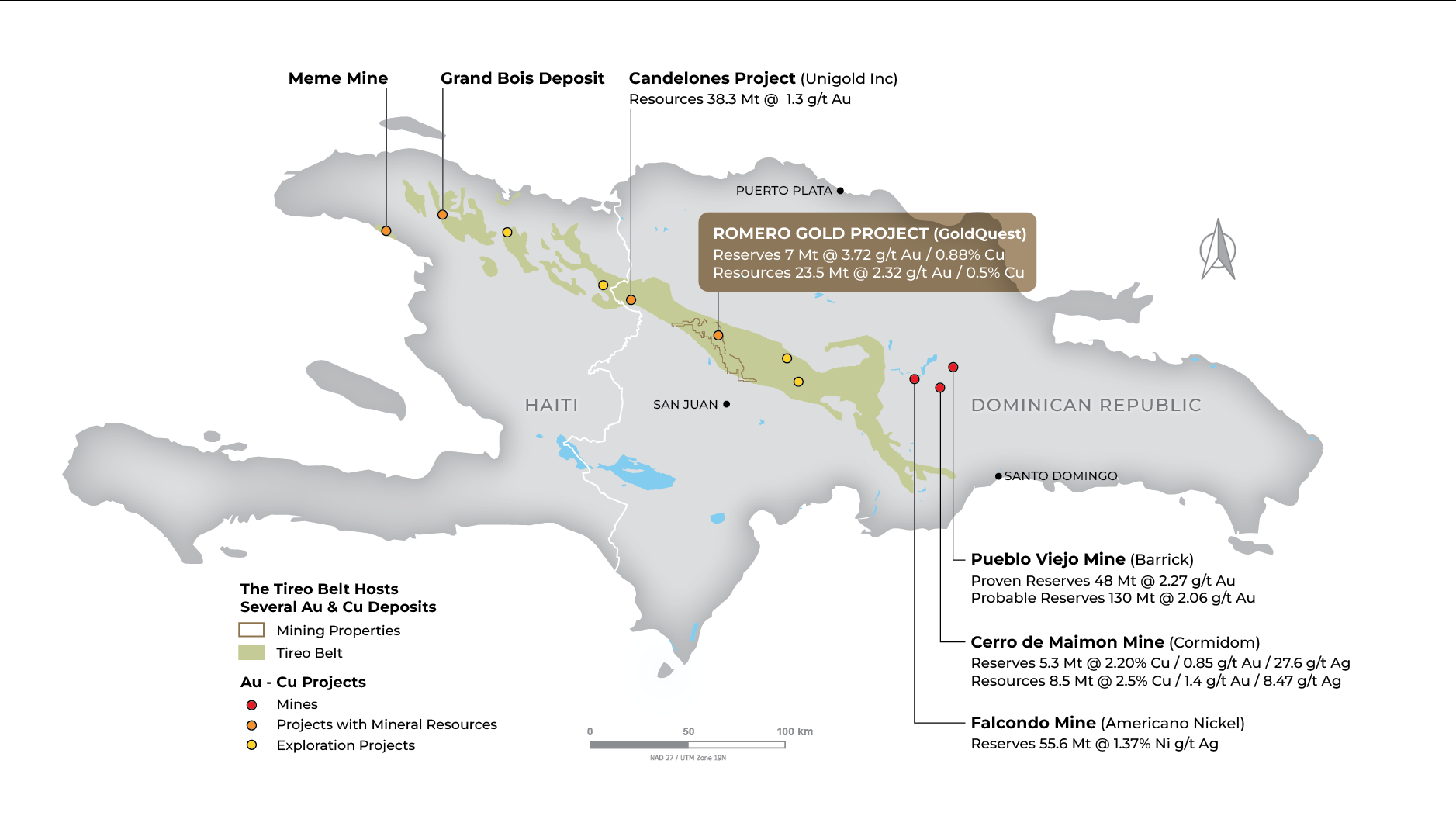

The Romero Project, which includes our Romero and Romero South deposits, is located within the La Escandalosa exploration concession of our Tireo Property which has an area of 3,997.0 hectares. The Tireo Property is located in the Central Cordillera of the Dominican Republic near the San Juan provincial capital of San Juan de La Maguana.

The Romero Project’s robust pre-feasibility study (PFS) completed by JDS Energy & Mining was announced on September 27, 2016.

This PFS, revealed an after tax NPV (5%) of US$203 million, and an after-tax IRR of 28%, and was based on a gold price of US$1,300/oz and US$2.50/lb copper.

Over half of Romero’s Mineral Resources are not included in the mine plan, as well as the entirety of Romero South. The unmined portion of the resources leaves significant room for potential expansion. The Romero Project is at the mine permitting stage with the company looking to receive Terms of refence to move forward in 1H2025.

As per our News Release dated June 11, 2025, GoldQuest received from the Ministry of Environment and Natural Resources of the Dominican Republic, the official Terms of Reference ("ToR") for the Company's Romero gold-copper-silver project.

This marks a significant milestone, initiating the final phase of the Environmental Impact Assessment ("EIA") process required to obtain an environmental license for the future development of the proposed underground mine.

Luis Santana, CEO of GoldQuest, commented:

"Receiving the Terms of Reference is a pivotal step in the responsible development of our Romero Project. This document confirms the project's Category A classification under environmental law and allows us to formally launch a comprehensive environmental study. Its issuance is a clear recognition of the project's quality and the Dominican government's commitment to advancing Romero."

Scheduled 2H 2025 work Romero includes Environmental work for the EIA and work towards a Bankable Feasibility Study ("BFS") , with additional drilling at Romero.

The Bankable Feasibility Study (1H 2026) will incorporate updated metal price and cost assumptions, and therefore update the economics based on much higher current metals pricing.

The planned 2,800 tonne-per-day underground mine focuses on the high-grade gold and copper “core” of the Romero Deposit to produce a saleable copper concentrate for shipment to offshore refineries.

Goldquest Mine Plan

Drilling at Romero will target resource expansion opportunities, aiming to potentially increase the mineral resource base beyond the current defined limits. In addition, specific holes will be drilled for metallurgical and geotechnical testing to support mine design, process optimization, and the overall BFS technical criteria.

The Romero Deposit was discovered in 2012 with spectacular drilling results. The Romero and Romero South deposits, located in the central part of GoldQuest’s Tireo property, are approximately one kilometre apart.

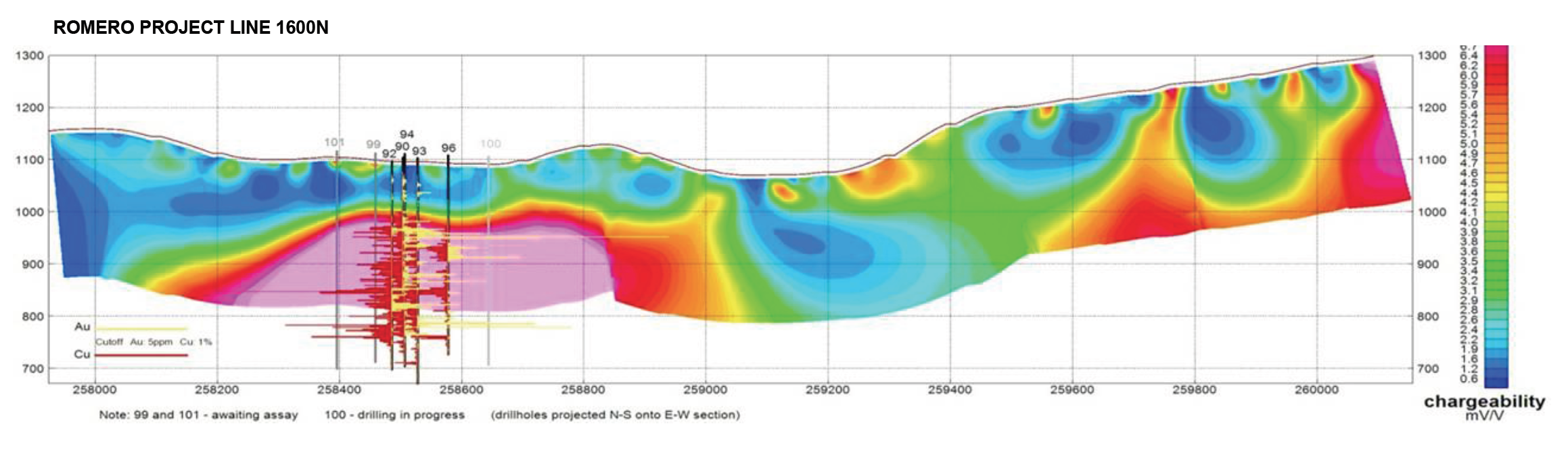

The Romero Discovery Hole, LTP 90, was the second last of a 15-hole-program testing an induced polarization ground geophysics (IP) target.

Hole LTP-90 reported 231 metres grading 2.4 g/t gold including 160.3 metres grading 2.9 g/t gold and 0.62% copper.

Notable drilling also includes hole LTP-94 which returned 235 metres grading 7.9 g/t gold uncut and 1.4% copper.

The Maiden Probable Reserves in the district included 7.03 million tonnes containing 840,000 ounces of gold; 980,000 ounces of silver, and 136 million pounds of copper.

The brownfields exploration potential in the Romero Concession, both in the vicinity of and in between the two deposits, is substantial, and will be tested once mining permit is obtained.

Mineral Resources:

|

Category |

Zone |

Tonnes |

Au (g/t) |

Cu (%) |

Zn (%) |

Ag (g/t) |

AuEq (g/t) |

Au Ounces |

AuEq Ounces |

|

Indicated |

Romero |

18,390,000 |

2.57 |

0.65 |

0.31 |

4.2 |

3.43 |

1,520,000 |

2,028,000 |

|

Romero South |

1,840,000 |

3.69 |

0.25 |

0.18 |

1.6 |

4.01 |

218,000 |

237,000 |

|

|

Total Indicated Mineral Resources |

20,230,000 |

2.67 |

0.61 |

0.30 |

4.0 |

3.48 |

1,738,000 |

2,265,000 |

|

|

Inferred |

Romero |

2,120,000 |

1.80 |

0.39 |

0.36 |

3.2 |

2.32 |

123,000 |

158,000 |

|

Romero South |

900,000 |

2.57 |

0.20 |

0.21 |

2.1 |

2.84 |

74,000 |

82,000 |

|

|

Total Inferred Mineral Resources |

3,020,000 |

2.03 |

0.33 |

0.32 |

2.9 |

2.47 |

197,000 |

240,000 |

|

(1) Effective data for the Mineral Resource is September 27, 2016

(2) Mineral Resources which are not mineral reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues.

(3) The quantity and grade of reported Inferred Resources in the estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as an Indicated or Measured Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

(4) Gold Equivalent Metal prices used were $1,400/oz Au, $20.00/oz Ag and $2.50/lb Cu and recoveries of 78.1% for gold, 94.6% for copper and 58.6% for silver.

(5) Columns may not calculate precisely due to rounding errors.

How We Found It

With previous experience, and proven development success in the Dominican Republic, our systematic prospecting approach across the entire country led our team to this previously unexplored area. Some key points in our discovery of Romero and Romero South include:

- Outcropping mineralized rocks with gold, copper and zinc led to the discovery of Romero South (formerly Escandalosa)

- After defining the Romero South deposit we initiated a ground IP program to look for other mineralized bodies (2011)

- A 15 hole drill program in 2012 of which the 14th hole discovered Romero

- Romero presented a new style of mineralization with thick (>200m) intervals of gold and copper mineralization

Geology

Romero is located on the south side of the Central Cordillera of Hispaniola and is hosted by the Cretaceous-age Tireo Formation volcanic rocks and limestones, which formed in an island arc environment. The deposit geology is a relatively flat lying sequence of intercalated subaqueous, intermediate to felsic volcanic and volcaniclastic rocks and limestones on the east side of thick rhyolite flows or domes. Mineralization is relatively stratabound and flat lying and is mainly hosted by a dacite breccia tuff.

The ROMERO PROJECT PFS Highlights

- Maiden Probable Mineral Reserves of 7.03 million tonnes containing:

- 840,000 ounces of gold

- 980,000 ounces of silver

- 136 million pounds of copper

- A 2,800 tonnes per day operation totalling life of mine gold equivalent production of approximately 1.117 Moz AuEq

- Annual gold equivalent production averaging 109,000 ounces per year

- Post tax Net Present Value @ (5%) of $203 million (pre tax $317 million)

- All-in Sustaining Cost of $595/oz AuEq

- Post tax Internal Rate of Return of 28% (pre-tax 38.6%)

- Initial Capex of $158.6 (Life of Mine $250.9 including sustaining and closure)

- Life-of-mine ("LOM") all-in sustaining costs ("AISC") of $595/oz gold equivalent ("AuEq") payable.

- Payback of capital within 2.5 production years.

- Pre-production capital expenditure estimate of $158.6 million, plus $92 million of sustaining and closure capital over LOM totaling $250.9 million.

- An eight-year underground mine at an average production rate of 1,022,000 tonnes per year (2,800 tonnes per day) with an average production of 109,000 recovered AuEq oz per year.

- Total metal recoveries consisting of 78.1% for gold, 58.6% for silver 94.6% for copper to a single concentrate for sale to copper smelters. There are no perceived penalty elements.

- The PFS contemplates an environmentally proactive approach. Some of these features include:

- A small surface footprint over the underground mine

- The use of cyanide is not included in the design. A flotation concentrate product will be shipped from the Puerto Viejo port to international smelters;

- 100% of the waste rock from the underground mine will be returned underground as backfill to eliminate the potential for acid rock drainage;

- The project is designed to capture run-off water to supply the mine, thus avoiding any water taking from the San Juan river;

- Tailings from the process plant will be filtered, dried and placed in a dry stack storage facility. No tailings ponds or dam structures will be required;

- Power will be supplied by a line connection to the domestic power grid;

- Ventilation fans will be located underground to reduce noise; and

- No relocation of the Hondo Valle village, or any settlements.

JDS Energy & Mining Inc. is a Vancouver based mining consulting company, who has extensive experience in mining and development studies. JDS assembled a multi-disciplinary international team of experts to conduct the Romero PFS including:

- Micon International Limited (Micon) (geology, mineral resources)

- Golder Associates Limited (geotechnical, tailings and water management)

- Allnorth Consultants Limited (process design)

- MineFill Services Incorporated (backfill plant design)

GoldQuest applied for a mining permit to the Dominican Ministry of Energy and Mining in November 2015 and the Environmental Permit process in November 2024.